As we approach the year 2024, many seniors are interested in discovering what Medicare Advantage Plans will offer. There are a lot of options, and it can be overwhelming to choose the right one for you. A Medicare Advantage Plan, also known as Medicare Part C, is an all-in-one alternative to Original Medicare that is administered by private insurance companies. In this article, we will provide you with a definitive guide to https://www.comparemedicareadvantageplans.org/medicare-advantage-plans-2024/, so you can make an informed decision when it comes to your healthcare.

As we approach the year 2024, many seniors are interested in discovering what Medicare Advantage Plans will offer. There are a lot of options, and it can be overwhelming to choose the right one for you. A Medicare Advantage Plan, also known as Medicare Part C, is an all-in-one alternative to Original Medicare that is administered by private insurance companies. In this article, we will provide you with a definitive guide to https://www.comparemedicareadvantageplans.org/medicare-advantage-plans-2024/, so you can make an informed decision when it comes to your healthcare.

- What are Medicare Advantage Plans?

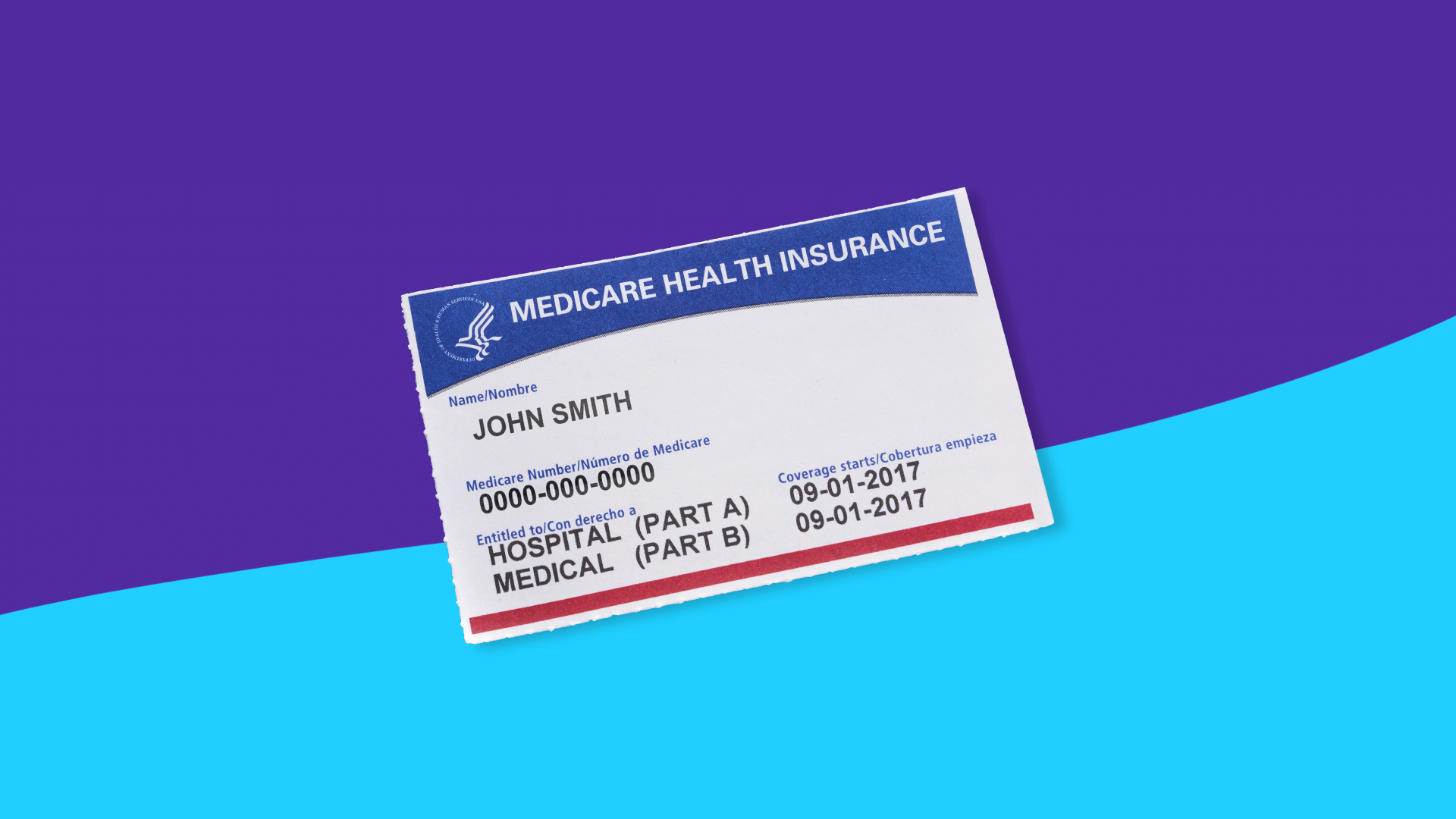

Medicare Advantage Plans are health insurance plans offered by private companies that have been approved by Medicare. Enrollees in Medicare Advantage Plans receive their Medicare Part A and Part B benefits through the private insurance company, and many plans include extra benefits such as prescription drug coverage, dental, and vision coverage. Some Medicare Advantage Plans also offer wellness programs that can help you live a healthy lifestyle and manage chronic conditions. It’s important to note that you must have Medicare Part A and Part B to enroll in a Medicare Advantage Plan.

- Types of Medicare Advantage Plans:

In 2024, there will be several different types of Medicare Advantage Plans to choose from. Health Maintenance Organization (HMO) Plans are the most common type of Medicare Advantage Plan and generally have lower premiums but require you to see doctors and specialists within a specific network. Preferred Provider Organization (PPO) Plans allow you to see providers in or out-of-network, and sometimes HMO Point of Service (HMO-POS) Plans offer a mix of HMO and PPO benefits. Special Needs Plans (SNPs) cater to those with specific health conditions. Lastly, Private Fee-for-Service (PFFS) Plans allow you to see any Medicare-approved provider who agrees to the plan’s terms and pricing.

- How do Medicare Advantage Plans cost?

Medicare Advantage Plan costs vary depending on the plan, your location, and the specific benefits offered. Premiums for Medicare Advantage Plans in 2024 may range from $0 to $300 per month, with some plans offering additional benefits like dental or vision coverage for an added cost. Some Medicare Advantage Plans may also have deductibles, copayments, or coinsurance, so it’s important to read the fine print and understand what you’ll be responsible for paying.

- How to apply for Medicare Advantage Plans:

Anyone who is eligible for Medicare can apply for a Medicare Advantage Plan. You can enroll in a Medicare Advantage Plan during your Initial Enrollment Period (IEP) – the seven-month period that begins three months before your 65th birthday month and ends three months after that month. You can also enroll in a Medicare Advantage Plan during the Annual Enrollment Period (AEP), which takes place each year from October 15th to December 7th. During this time, you can switch from one Medicare Advantage Plan to another, or enroll in one for the first time.

- Key factors to consider when choosing a Medicare Advantage Plan:

When choosing a Medicare Advantage Plan, there are a few key factors to consider. First, it’s important to ensure that the plan you choose covers your specific healthcare needs – make sure your doctors, hospitals, and prescription drugs are covered. Second, consider the cost of the plan – premiums, deductibles, copays, and coinsurance. Finally, investigate the plan’s ratings – Medicare plans are rated on their quality and can be found on the Medicare Plan Finder.

Conclusion:

Medicare Advantage Plans may be a good option for seniors who want additional health benefits beyond traditional Medicare coverage. In 2024, there will be several different types of Medicare Advantage Plans to choose from, with a range of costs and benefits. It’s important to consider factors such as the plan’s coverage, cost, and rating when selecting the best Medicare Advantage Plan for your healthcare needs. Take the time to do your research and compare plans before making a decision. Consult with your doctor or an insurance agent to help you choose the best Medicare Advantage Plan for your unique situation.